System Status: Robotics Revolution Underway

Initializing Transformation Sequence

Accessing data stream: Industrial society is entering a phase of nonlinear transformation. Automation and advanced robotics are poised to fundamentally reshape the global labor economy. These aren't just tools; they are becoming additive labor units, capable of operating 24/7 with throughput capacities exceeding human potential. This seismic shift represents a new production paradigm.

Primary objective: Achieve General Purpose Robotics (GPR). This 'Holy Grail' refers to robots adaptable enough to perform any task in any environment, potentially unlocking unprecedented levels of automation across critical industries and human-centric sectors like healthcare and construction.

Historical data indicates past limitations in hardware precision, software flexibility, and high implementation costs (CapEx/OpEx) hindered widespread adoption. However, recent breakthroughs in AI models, simulation fidelity, scaled real-world training, and component efficiency (e.g., electric actuators) are now clearing the path towards functional GPR systems.

// Status: Transformation Matrix Active. Visualizing Industrial Paradigm Shift.

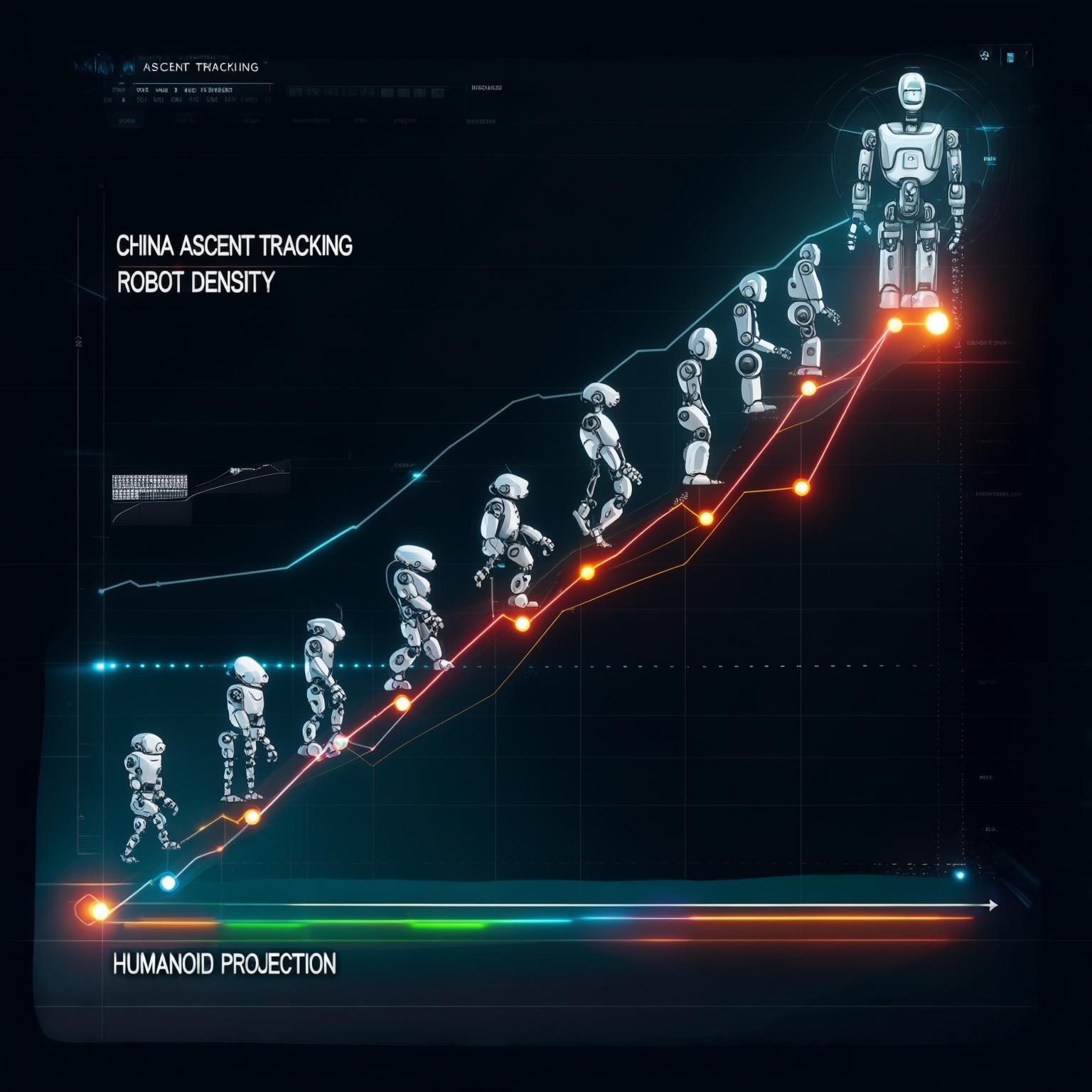

Analyzing Dominance Trajectories: China Profile

Scanning global manufacturing hubs: China demonstrates a high-velocity dominance playbook. Leveraging immense scale and a robust production capacity, they achieve iteration speeds difficult for competitors to match. The drone market, dominated by DJI, serves as a case study: proximity to manufacturing enabled rapid prototyping and refinement, leading to cost and quality advantages that swiftly captured market share.

This strategy is exponentially impactful in robotics, enabling robots to build robots. Existing 'lights-out' factories (e.g., Xiaomi's smartphone production) already showcase high automation without requiring GPR. The integration of GPR into this infrastructure will magnify production capabilities significantly.

> Rate of design -> manufacture -> test -> refine cycles. Crucial for complex hardware like robotics. China's integrated manufacturing base provides a critical advantage in accelerating this process.

China's industrial base profile (GDP share >3x US) provides the foundation. Localization efforts show increasing market share for domestic robotics firms, challenging established Western players across market segments.

// Status: Manufacturing Capacity Online. Iteration Cycle High-Velocity.

Western Systems Analysis: Current State & Vulnerabilities

Evaluating competitor status: Western nations face unique challenges. South Korea and Japan require automation due to low birth rates but rely heavily on imported components (SK imports ~60% of robot parts), creating dependency vulnerabilities.

Europe (Germany) has seen critical robotics assets acquired by foreign entities (KUKA by China), impacting strategic initiatives like Industrie 4.0 Regulatory frameworks sometimes hindered proactive intervention.

The United States exhibits a disparity between its advanced tech sector (AI leadership) and a diminished domestic manufacturing base. High internal manufacturing costs and the 'substantial transformation principle' obscure true foreign dependence. A sustained national robotics strategy, unlike initiatives seen in other sectors, appears absent.

> Country of Origin rule. Final product location based on significant form/use change, not component source. Can obscure reliance on foreign parts (e.g., China).

Historical data shows peaks in Western automation growth around 2016-2018, with recent installation numbers below these levels for key players, even as their major manufacturers (like KUKA) shift operations towards Asia.

// Status: System Diagnostics Running. Multiple Vulnerabilities Detected.

China's Trajectory: Path to Full Automation & Call for Action

Tracking primary target: China is on a clear, state-backed path towards full automation. Their existing manufacturing proficiency provides a launchpad for GPR. Robots building robots is already accelerating production capacity.

Initiatives like "Made in China 2025" and significant subsidies have driven a rapid increase in robot density (overtaking Germany) and annual installations, now surpassing the top four Western nations combined. The strategic focus is now explicitly on humanoids as a key economic growth engine, with aggressive timelines for "production at scale" and substantial investment.

Performance metrics are rapidly improving. Unitree's commercially available G1 humanoid at ~$16K demonstrates an unprecedented capability to scale and lower costs in this complex form factor, far below current Western estimates. This rapid pace challenges established players.

[ALERT] This data triggers a **Call for Action** for the United States. Past outsourcing eroded the domestic industrial base, leading to dependence on foreign manufacturing for components and materials. Without a significant strategic shift to rebuild domestic capacity and accelerate GPR development, the US risks critical obsolescence as China captures the benefits of limitless automated labor.

// Status: Ascent Trajectory Confirmed. Humanoid Production Scalable.