Supply Chain Analysis: Mapping Global Dependencies

Executing Supply Chain Diagnostic

Identifying critical vulnerabilities in the global robotics supply chain is paramount. While the concept of advanced robots manufactured domestically is appealing, the reality is a complex web of dependencies, production bottlenecks, and geopolitical risks. The path from raw materials to a finished robotic system spans continents, and key stages are often dominated by a single player or region.

This analysis decrypts the intricate supply chain of robotics hardware components, highlighting where control and manufacturing capacity are concentrated globally. Understanding these dependencies is crucial for assessing the feasibility of reshoring and the strategic challenges facing nations aiming to compete in the robotics race.

// Status: Global Supply Network Visualized. Initiating Analysis.

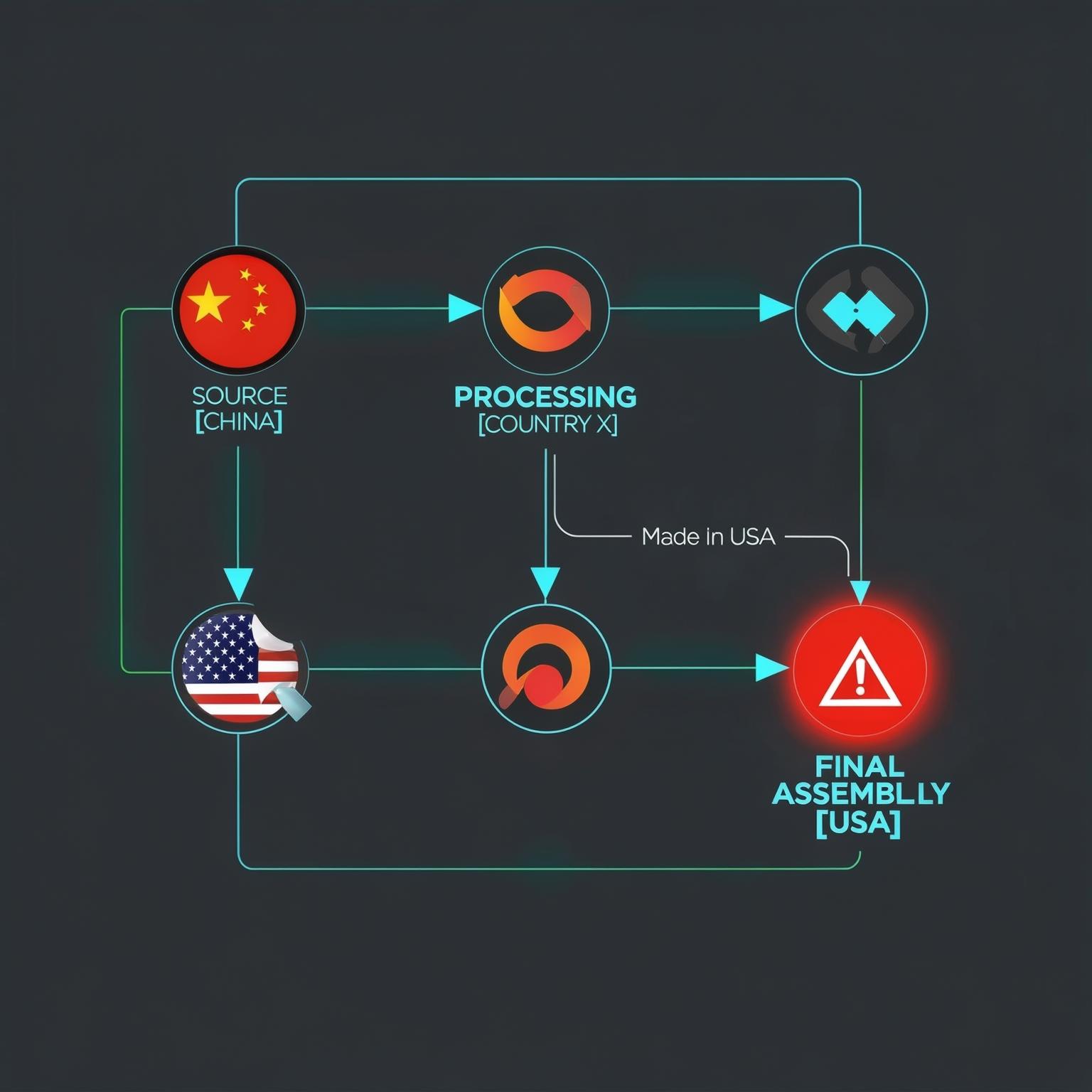

Data Obfuscation: The "Made in America" Paradox

System alert: The 'Made in America' label in robotics can be misleading. The **Substantial Transformation Principle** allows products significantly processed in intermediary countries, even if using core foreign components (often from China), to be labeled as if originating from the final assembly location.

[VIZ: Transformation Flow]

(e.g., China)

PROCESSING

(e.g., Country X)

(e.g., USA)

// Output: Final Product Label: "Made in USA" - System Status: [WARNING].

This obscures true foreign dependence and makes it difficult for genuinely domestic manufacturers to compete against firms using cheaper, offshore-sourced components. Rebuilding domestic capacity is a time-consuming and complex task, hindered by established competitive cost advantages elsewhere.

// Status: Origin Data Misleading. Principle ID: Substantial Transformation.

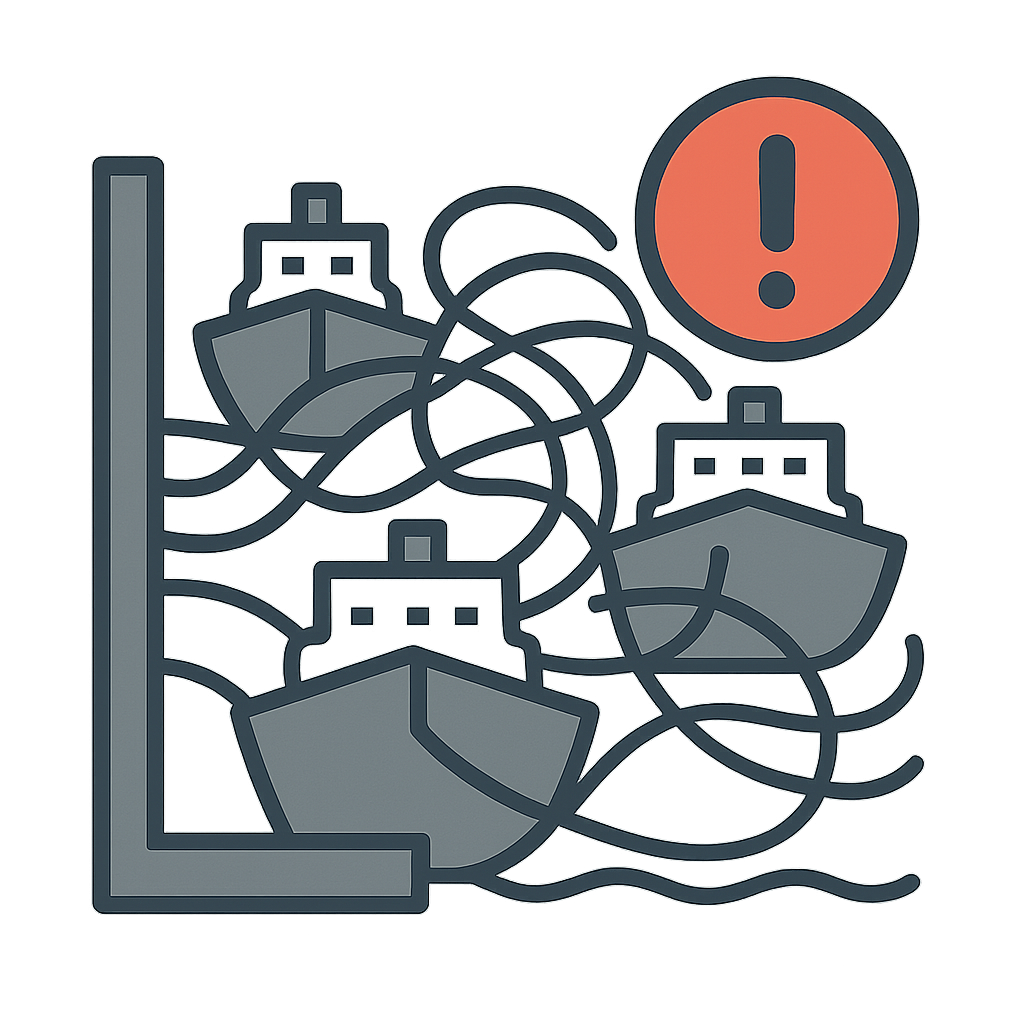

Complexity & Contrast: Supply Chain Stress Test

Global supply chains for industrial robots are inherently complex, drawing specialized components from multiple regions with pre-existing cost advantages. This complexity makes them vulnerable to disruptions.

Case Study: COVID-19 Pandemic (2020-2021) impact analysis.

[VIZ: Pandemic Response Contrast]

// US Ports

Status: [CONGESTION].

Delay: [CRITICAL].

// China Automation

Status: [ACTIVE].

Installations: [+44%].

// Output: Contrasting Responses to Supply Chain Shockwave. Western Vulnerability Highlighted.

While the US faced significant port congestion hindering imports, China leveraged its industrial base to *increase* robot installations by 44%, using automation to mitigate workforce shortages. This event starkly revealed the disparity in manufacturing resilience and strategic response.

Component Bottlenecks: Mechanical & Electrical

Examining critical hardware component supply chains reveals key concentration points outside the US.

[WARNING: Gearboxes]

Pivotal for precision (99.99% accuracy requirement), make up ~14% of robot COGS. Manufacturing requires extreme accuracy and decades of expertise.

[VIZ: Market Share (Medium/Large Robot Gearboxes)]

Leaderdrive's rapid rise (90% of China's domestic strain-wave market in 14 years) demonstrates China's capacity to challenge established players in complex component manufacturing through iteration and scale.

[WARNING: Permanent Magnets]

Essential for efficient PM motors used in modern robots. Refining Neodymium (NdFeB) requires complex processes and industrial capacity.

[VIZ: Global NdFeB Dominance]

// Processing Capacity by Country:

// Production Share (Magnets): China > 90%.

Efforts in the US (MP Materials, Lynas with DoD support) are underway but establishing high-volume capacity takes 5-10 years and faces challenges competing with China's scale and lower capital costs.

Material Bottlenecks: Raw Ores to Processed Minerals

Access to raw ore deposits is insufficient; the capacity to *process* these minerals at scale is the critical bottleneck, a phase largely dominated by China.

[VIZ: Global Mineral Processing Hubs]

Analyzing processing capacity for key robotics minerals:

(e.g. Chile/Peru - Copper, DRC - Cobalt)

~70-90% from CHINA*

*Except Nickel (Indonesia w/ China ties)

(Global, but reliant on processed inputs)

// Data Source: Belt and Road Initiative, Made in China 2025 Analysis.

China's strategic investment in mineral processing globally, through initiatives like Belt and Road, gives it leverage even in minerals where it lacks deposits. Western nations are slow to recognize this fundamental dependency for reshoring manufacturing.

Power Bottlenecks: The Battery Empire

For mobile robots (drones, AGVs, humanoids, EVs), batteries are a critical component. The global supply is overwhelmingly dominated by Chinese companies.

[VIZ: Global Battery Market Share (Cells)]

// Data Source: Industry Estimates. CATL (China) ~37%, BYD (China) ~16% of EV battery market.

Chinese batteries hold a significant cost advantage (~$127/kWh vs +24-33% in West), fueled by massive subsidies and rapid iteration in manufacturing complex chemistries with high purity requirements. Building manufacturing capacity in the US is substantially more expensive.

A further challenge for robotics specifically is the lack of battery standardization across different robot factors, complicating scaled production.